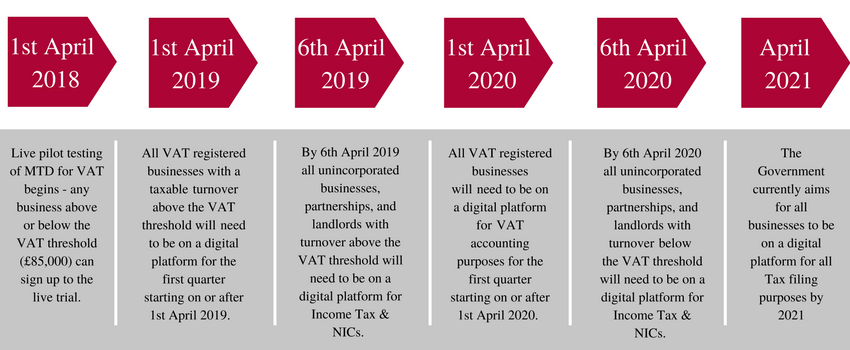

In the wake of the Government’s Autumn Budget, and the most recent updates that have followed over the past few months to the proposed plans for Making Tax Digital, We’ve kept our ears to the ground and have created our Making Tax Digital Timeline that outlines the important dates in the legislation, and the implications and obligations involved for your business!

However, as is so often the case with Government proposed legislation regarding businesses and the way accounting is conducted, there is the potential for change until the legislation is set in law. We will continue to monitor and advise with any future changes that may be made.

Price Davis will of course remain vigilant in keeping up-to-date with the latest Making Tax Digital time-frames and obligations required from you and your business, in order to keep you informed with the most current news.

As Silver Champion Partners, Certified Advisors, and Migration Certified with Xero Accounting Software, we can offer your business expert advice and guidance in getting your business set up on this selected digital platform.

If you’d like to discuss your digital record keeping options further, feel free to get in touch with Alistair, our resident Xero Expert! Or contact us on 01452 812491. Why not find out more about How We Work to discover why we should start working together.