The time a business owner decides to seek additional finance can be both an exciting, and intimidating one. Whether it’s the prospect of growing your business, or covering operational costs when cash-flow is tight, it’s a process that every small business is likely to undertake at some stage in its lifetime. The reasoning behind seeking a financial boost will differ drastically. Dependent factors such as the purpose, length of time required, and the nature of your operations will all be an influencing factor when deciding what type of finance your business needs.

Before deciding anything, you should ask yourself the following questions:

What do I need the finance for?

It is important to understand what you are getting finance for. Having a clear target or goal in mind will help you spend the finance more meticulously. Will you be financing growth, looking to purchase a new asset or just looking to keep your operations going through a tough period? What you require the financing for will have a significant impact the type of finance you will seek.

How much will I need?

Borrowing too much or too little can lead to further issues down the road. Acquiring too little could mean you miss your target deadline for the project. Get too much and you could be paying unnecessary interest charges.

What time period will I need the finance for?

If you require finance, to cover a cash-flow shortage for example, it is vital to know how long any potential finance will likely be needed for as this will also influence the amount required. Being realistic with the repayment time-frame is key.

Finance Options available for Businesses

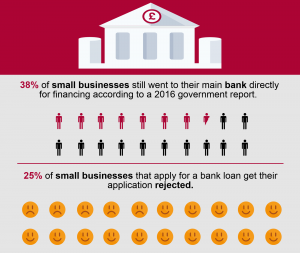

Many business owners will assume that the only option when it comes to financing their business is to head straight to the bank and beg for a hefty loan or overdraft facility. There are a variety of options available to start-ups, and small businesses when sourcing credit and finance solutions that should be considered long before calling the bank!

Internal Sources

Before charging straight to the local bank with a burlap money sack, it would be beneficial to look for resources within their own business first.

Equity Sale

Equity Sale is often an easy way of raising finances for a business via an investor. By selling equity of the business, you are selling part of the business and therefore have relinquished some control. However, it could be a less cost effective method of finance in the long run; for example a £10,000 investment for 20% equity could diminish your personal income due to the sharing of dividend income. This source of finance is less suited for businesses that have not yet launched as potential investors would normally require some level of ‘track record’ before investing.

Share Issuing

A Limited company has the ability to raise and sell shares to individual investors in order to raise additional finances. Similar to an equity sale, the selling of shares can mean that overall control of the company has been diluted resulting in less control & authority. In a way, issuing shares can be both internal, sold to individuals already within or close to the business, or external, being sold to an outside investor.

Partner Investment

If the business is set up as a sole trader or a partnership, another method of bringing in additional funds would be by seeking a partner to invest in the business. By bringing a partner into the business, you could benefit from having access to funds with no interest or repayment, apart from through profit share, as well as bringing in fresh expertise and outlooks on the business which could lead to future successes. However, with a partner, y you must consider that your personal income may decrease initially due to the nature of profit sharing. By bringing a partner into the business as a sole trader, the businesses legal entity will need to be restructured as a result. This may have a knock-on effect for how both you, and the business reports and stays compliant with HMRC.

External Sources

There are a plethora of options available for businesses seeking finance from an external source. From bank loans, to Government grants, gaining the right type of finance for your business should never be made on a whim.

Business Loans

Usually issued as a lump sum or as a continuous stream of credit up until an agreed upon limit. There are typically 2 types of loans, secured and unsecured. A secured loan is backed by collateral e.g. a guarantor, personal guarantee, or asset security. As such, personal assets can be seized if you or the guarantor are unable to repay the loan.

An unsecured loan can be taken out without any of the above assurances, but as you might expect with such an agreement, the interest rates associated with it tend to be higher.

With an array of banks and business loan companies out there, there are no shortage of options when it comes to securing a business loan. You should however, take time to understand the terms and conditions regarding repayment, as taking out another loan to repay a loan is never a prudent plan!

Asset Finance

If your cash-flow does not allow for the outright purchase of capital assets such as Vehicles, Operating Machinery or IT equipment then the following Asset Financing options are worth considering: Hire Purchase – allows you to purchase equipment and repay in monthly instalments. The business will eventually own the equipment, but until all payments have been made you are essentially hiring it. Finance Leasing – which works similarly to hire purchasing but the difference being your business will never own it, even if you have repaid more than the original value of the equipment. Furthermore, the equipment will not appear on the balance sheet and therefore you could offset the rental costs against your profits and reclaim the VAT. Finally, Equipment Leasing – involves the lender purchasing equipment, then renting it to your business. This means that you can gain access to the equipment immediately, but only need to have a small percentage of the cost upfront. At the end of the agreed upon leasing period you have the option to purchase, upgrade, or return the equipment, making it beneficial for ad-hoc, or cyclical jobs.

Grants

Under certain circumstances businesses will be eligible to claim a non-repayable grant from the government, certain organisations, or bodies. These are often designed to help start-ups and SMEs to build and grow their operations. For Example, ‘Horizon 2020’ is an EU wide grant that supports SME’s with funds between £100k and £10m. Receiving a grant as a start-up business could make your venture a successful one.

Crowdfunding

Crowdfunding is a unique, and very 21st Century method of raising finances! Crowdfunding provides a chance for organisations to provide details & concepts of their products and services to a wide audience online, who can then invest in the project.

This can be a somewhat drawn out process, and not every product or business will thrive due to crowdfunding, but it can give your product/service an instant customer base when it eventually launches. There are three main types: Donation crowdfunding – where you do not get anything in return; Debt crowdfunding – where you get your investment back with interest; or Equity crowdfunding – where you exchange investment for an equity share in the business. This practice has become increasingly popular among charitable organisations, and R&D based tech companies.

Overdrafts

Drawing out an overdraft is a quick and easy way to access additional funds. While often small in value compared to some of the financing methods mentioned previously, it can be ideal as small and short term financing options, such as covering a cash-flow shortage for a month or two.

Final Thought

When considering whether or not to take out any form of finance, it would be prudent to seek professional advice. If the business is suffering from a cash-flow shortage, an accountant can draw up a series of forecasts predicting the extent of the issues and therefore providing an indication of the level of finance required, as well as how long it will be needed.

Not all sources of finance will be suitable for all kinds of business as every situation is different, and the personal preference of the business owner will be a highly influential factor. We are more than happy to discuss possible credit and financing options for your business, and can help point you in the right direction to those that specialise in the particular funding you chose, so feel free to get in touch with us on 01452 812491 or email craig@pricedavis.co.uk.