Working from home is no new thing, but this year Covid-19 has encouraged more people than ever to carry out their roles at home. Due to government guidance and large business savings, working from home could be here to stay for many people.

Separating work from home life can be difficult, particularly when carrying out your role at home. Creating boundaries between the two, by designating a specific work space within your home, or to create a space outside your home – converting an old shed or building a ‘office pod’ – are becoming popular ways of maintaining balance in your work and home life.

As with most things tax related it really is worth getting advice on the best set up for your personal situation. Do you have a fixed or temporary structure? Do I buy it through my company or own it personally and rent to myself at market value? The right answer to you will depend on funding options, your personal income sources etc and there is not a one size fits all approach to this!

What is an ‘office pod’?

Office pods can take many forms, from glorified sheds, to fully insulated double-glazed free-standing units with plumbing and heating.

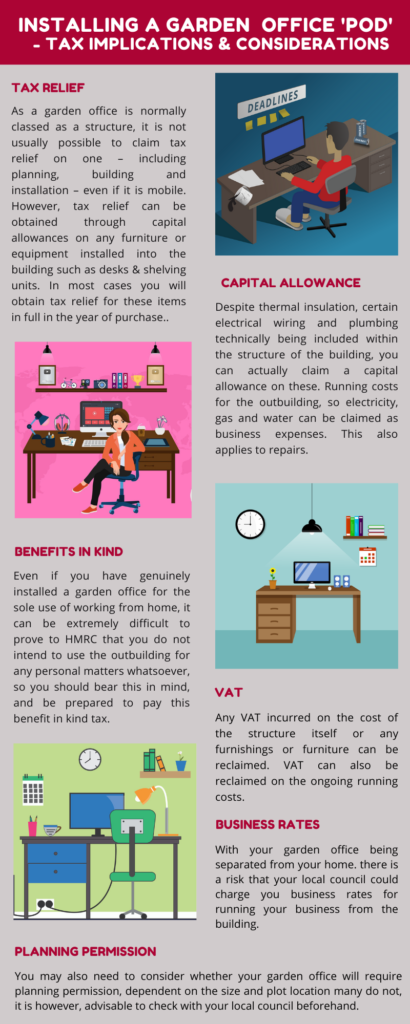

Provided certain conditions in terms of size of pod and location on its plot are met they often do not require planning permission, however, these developer rights also depend on the usage intended for the pod (business only, personal only, a combination of the two).

The type of usage may also have some tax implications.

Planning Permission & Ownership

Before you get too far, It would be worth checking with your local council of any regulations that would need to be met if you were to build a garden pod.

You may also need to discuss with the council what business rates may be attached to the pod. Current Government regulations suggest that making changes to your home to accommodate a business can create business rate issues – these may be mitigated with small business rates relief which could reduce the charge to nil, provided the business only uses one property with a rateable value of less than £15,000.

Pod Personal Ownership

If the pod will be a mix of personal and business use, you could consider footing the bill personally as although this can be more costly in the short term, it will make it a lot simpler to deal with in the longer term.

By paying for the pod yourself, you may need to withdraw additional funds from your business to pay for the installation. If your business is incorporated, it could result in additional tax costs on additional dividends or salary, and could mean forgoing any potential tax reliefs for the unit which your business may otherwise have been able to claim.

Pod Business Ownership

If the pod is intended to be 100% for business use only – and you are able to prove this if questioned – you may be more inclined to pay for the build through your business & claim back tax relief if you can.

A garden pod could well fall under the structures category within the Structures and Buildings allowance (SBA) introduced in 2018. This provides a 3% relief per year on the costs of building non residential structures.

The relief however is not permitted if the structure is being used for any residential purposes and therefore you may have to provide evidence that the pod will only / is only being used for business purposes.

Other accumulated costs that are also unlikely to qualify for tax relief include costs of planning, legal expenses, and any architectural design work you may need. However, these costs may be included within your accounts and offset in the future.

Running Costs & Charges

Pod Personally Owned

If the pod is owned personally, you will not be able to claim tax reliefs for the installation.

However, you may be able to claim and recover some business related costs through your business – and subsequently, your business will be able to claim tax relief on these costs. There are 2 ways you can claim this, either through charging rent to your business for use of the pod, or by making an expense claim.

There are positives and negatives to both options depending on your personal circumstances. We have detailed some of the aspects below but at Price Davis we can help talk you through these choices.

Charging Rent To Your Business |

|

Expense Recharge |

|

Pod Business Owned

If the pod is owned by your business, reclaiming the running costs for the pod can be much simpler. The vast majority – if not all – of the running costs can be claimed back as a business expense.

Claiming Equipment Costs

On top of running costs, your business can cover the costs of any furnishings or equipment that you may need in order to conduct your work and claim back capital allowances on these costs.

This is permissible on the assumption that personal use of the pod is absolutely minimal.

Home Working Allowances

Individuals working from home are able to claim back some tax relief for the additional costs they incur from working from home. These can include costs from increased electricity use, heating, business calls etc.

There are 2 methods of reclaiming this allowance. The simplified method is to claim a flat £26 per month ( or £6 per week ) to cover the added costs of working from home. Alternatively, the more onerous option, you could keep paperwork detailing your exact monthly usage in order to claim back the exact costs of working from home for the period.

VAT

If your business is VAT registered, you may be able to claim back the VAT on certain costs involved in the costs of building and installing the office pod.

However, seemingly with all things VAT related, these considerations can be very complex in nature and the exact intended use for the pod will need to be extensively proven to be for business use.

There may also be added complexities if your business is on the Flat Rate VAT scheme as reclaims can only be made on capital assets with each individual purchase bhaving a value above £2,000. Under the flat rate scheme VAT also is not recoverable on any goods or services, so costs incurred for advice about the pod is not acceptable.

Sale of the Property

Another issue that may arise down the line is how the office pod will be considered when or if you come to sell the property. Depending on the decision made on the ownership of the pod, there will be different treatments on the pod when it comes to the sale of the property on which it sits.

If the pod is used both personally and for business use, restrictions on Private Residence Relief (PRR) for Capital gains Tax (CGT) are avoided when you come to selling your property – whether you sell with the pod or not.

CGT relief is typically denied on any part of a dwelling house which is used exclusively for the purpose of a trade or business (this included any free-standing structure like a pod in the garden). Where the pod is exclusively for business use, then the gain relating to that room or area needs to be apportioned out and tax applied.

If the Pod is Owned by the Business

There may be additional hurdles if the office pod is owned by you business rather than by you personally.

If you are selling the property alone and plan to relocate the pod to your new property – at your business’ expense – you will only need to consider if there is any PRR restrictions on the land the pod was ‘previously’ located due to it being used solely for business use.

However, if the pod is being sold alongside the property, then your business will need to receive some proceeds from the sale of the asset in addition to any PRR restriction on the land the pod is built.

To simplify this process, it might be easier to ‘transfer’ ownership of the pod to the homeowner before the sale of the property. Doing so however may trigger tax charges for your business from the sale of the asset.

Final Thoughts

Whether you’ve been thinking of building a garden pod exclusively for business use, or whether you’re combining business and personal use – there are many considerations to make that will all likely have an impact on your personal finances as well as your taxable position.

For more details on which options might be more suitable for you based on your individual and business circumstances, give the team a call on 01452 812491 or send an email to info@pricedavis.co.uk.