What is Forecasting?

I’m sure you need no reminding that, say it with me, “cash flow is king” for all businesses. Being able to generate cash, pay bills, pay staff and suppliers or invest in growth is what keeps a business alive. There is nothings more unfortunate than a profitable business having to cease trading due to an insufficient level of working capital.

Forecasting is the principle of looking at the future picture of the operations of your business, in order to predict peaks and troughs, possible growth potential, and financial positioning. The more insight gained at an early stage the better. It is tricky to predict exactly what will happen in the future, but making an educated assessment based on previous performance, and being realistic about how much current & immediate future business you can achieve will put you in good stead.

Why Forecast Cash Flow?

Forecasting cash flow can show you whether your business is meeting its targets and Key Performance Indicators (KPI’s). Comparing your business’ forecasted performance to its actual performance can help identify which aspects of your business are not meeting expectations and can identify where business owners should focus their precious time.

Calculating future cash flow can also help to pinpoint opportunities that your business can take advantage of. Understanding that you will have the resources to take on additional staff, purchase/rent equipment that can streamline your operations or to gain more business can be instrumental to maintaining the financial performance. In a similar vein, live forecasting can highlight cash flow vulnerabilities or shortages which allows you to decide on how you will fund that shortage before you even get there, cutting out some of the stress.

Among the more obvious advantages of cash planning & forecasting, is the benefits it reaps come tax time. Being able to set aside cash to pay income or corporation tax is just another simple way to keep you compliant with HMRC and off your back for another year!

What Should be Included in a Cash Flow Forecast?

The starting point for a cash flow forecast is with the following 3 fundamental pillars:

Predicted Sales

Firstly, you will need to predict your likely sales figures for the period being forecasted for. This is achieved through looking at the historical sales of your business for the same period accounting for any seasonal, cyclical, or advertising campaigns that would impact on sales.

Whilst important, you should not only look to the past, you should consider future contracted orders, how future market forces, and promotional campaigns might affect your future sales. This part of the process becomes particularly crucial for start-ups with no historical data to look back on.

Estimated Payment Period

The next priority is to understand and record the expected timing of receiving payments.

It would be a noteworthy point to remember possible late payments in the period you are forecasting for, as well as late payments from previous periods that may be received in the forecasted period.

Anticipated Costs

Finally, after all projected incomes have been calculated, it’s time for the scary part – calculating your costs for the period.

These costs come in 2 forms, both of which need to be considered – fixed, and variable.

Fixed costs, by nature, should be relatively straightforward to calculate due to them being a constant price, for a constant period – such as rents, salaries, or subscriptions.

Variable costs, however, can be a little trickier to accurately predict. Constant fluctuation of costs such as stock, or materials, will require you to look both at historical data, as well as predicted sales for the period, in order to accurately anticipate these outgoings.

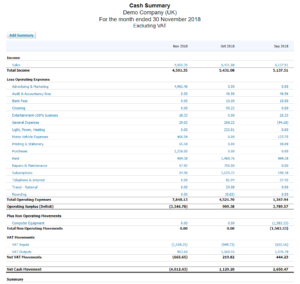

Forecasting With Xero

With Xero accounting software, you can produce a simple forecast for your business with a few clicks of button. Through the software’s cash summary comparison reports, you can easily create useful cash flow forecasts, of course like with most things this comes with a caviat that the output of these reports is only as good as the information input!

Xero is highly tailorable for business owners and can offer unique insight through a vast library of over 700+ integrations and applications. Specialist Xero integrations can provide much more in-depth and sophisticated insight into your cash flow reporting. You can set up live alerts based on set parameters so you can identify potential cashflow and KPI variances as soon possible. Price Davis can assist in the set up and delivery of this key management information to aid calculated decision making.

Final Thoughts

Being able to produce concise and accurate cash flow forecasts can be instrumental in helping you plan for growth, or to highlight a period of reduced financial capability. Knowing this type of information at an early stage can help you plan, apply for funding or look at strategies to succeed financially.

Having fully embraced the Digital age here at Price Davis we are well equipped to assist with and deliver efficient and timely cash flow forecasting to assist with planning and accurate decision making to take your business in the right direction for success. Feel free to get in touch with us today on 01452 812491, or email Alistair@pricedavis.co.uk.