What is the SEISS?

The Self-Employed Income Support Scheme (SEISS) was offered to self-employed individuals who lost income, due to COVID-19 outbreak and the subsequent restrictions imposed.

These grants are designed to ‘supplement’ the income of self-employed individuals whose income has been reduced specifically due to the disruption caused by Covid-19.

Self-Employed after 5th April 2019

Individuals that were considered self-employed after the 5th April 2019 were originally left out of receiving support under this scheme from the first three quarterly payouts to 31 January 2021.

However, due to persistent lobbying the Self-Employed Income Support Scheme is being opened to business owners who began trading after April 5th 2019.

Before a claim can be made though, an additional hoop or two may need to be jumped through:

- The first being that your tax return for the 2019-2020 period needs to have been filed before midnight on the 2nd March 2021.

- The second is that your business must have been negatively impacted by the pandemic, with your self-employed profits contributing to at least 50% of your income and not exceeding £50,000.

Self-Employed Before 5th April 2019

If you had qualified for any of the previous three grants, then you should also qualify for the further grants that are being issued in 2021.

However, there are certain circumstances that will mean you are no longer eligible for the grants – for example, if your business is no longer being adversely disrupted by the Coronavirus pandemic.

If this will be the first time you are making a SEISS claim, you may need to do so using your online tax account.

Claiming the Fourth Grant – 1 February 2021 to 30 April 2021

The fourth grant in the scheme is claimable from late April and covers the period of February to April 2021.

This grant is intended to cover three months of ‘average’ profits, with a limit of £7,500.

Claiming the Fifth Grant – 1 May 2021 to 30 September 2021

**DISCLAIMER – The details regarding the 5th grant may be subject to change as HMRC guidance has yet to be published. However, the below information is what we know so far**

The fifth grant will be available to claim from late July, and covers the period from May – September 2021.

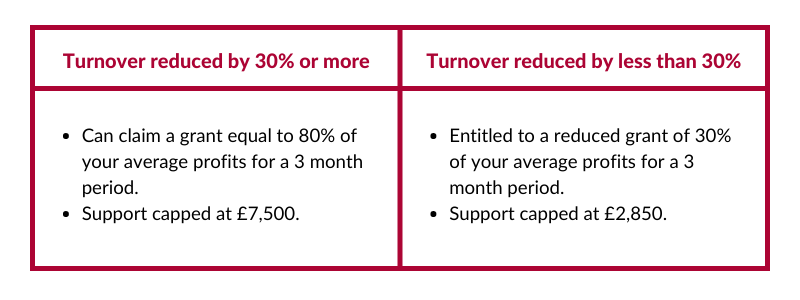

The level of support the grant will offer will depend on the impact on your profits from the Covid-19 disruption:

While beneficial that many businesses will be able to recoup at least some of the lost income caused by the Covid-19 disruption, there is a potential flaw in the fifth grant’s scope.

Although the grant covers a five month period between May – September, the actual payout due is based on only a three month period.

This raises potential queries – even among us – about what to do with the remaining two months the grant covers.

For a more comprehensive overview on your eligibility, and the process of claiming the 4th & 5th grants you can find it here.

Final thoughts

It’s been a difficult time for many self-employed individuals over the past few months and it may be tempting to apply for the grant regardless of your business’ financials.

However, it’s important to remember that this grant is only open to those who have been adversely affected by the disruption caused by the Covid-19 disruption. These grants are also subject to tax and should also be considered during your calculations.

For more information on the support schemes currently available for businesses and individuals, you can check out our Resources page. To speak to a member of our team to talk through your situation, please give us a call on 01452 812491, or send us an email to info@pricedavis.co.uk.