Welcome to part 2 of our “VAT Explained!” blog series. This blog will outline the different schemes available to your business when accounting for, and paying VAT. If you have yet to read Part 1 of the series, you can find it by following this link.

Cash Accounting Scheme

This scheme requires the business to calculate their VAT payment based on when payments are made and received rather than when an invoice is raised. This boasts an obvious benefit for those businesses that receive payments in arrears, as well as being a buffer against payments that aren’t received at all – no payment from customers means no VAT to pay.

However, while this scheme has its benefits and may be more convenient for businesses, the nature of the scheme requires careful tracking of receipts and payments made to ensure that you don’t pay VAT on both the invoice and when you pay the invoice!

Flat Rate Scheme

The Flat Rate scheme is ostensibly the simplest of the 3 schemes. However, there are certain pitfalls to be aware of. If your business is utilising the flat rate scheme, you will simply raise invoices as normal, adding 20% VAT to the total as standard. You would then apply your industries flat rate on top of the VAT inclusive invoice. It is this added flat rate of VAT that is then paid to HMRC.

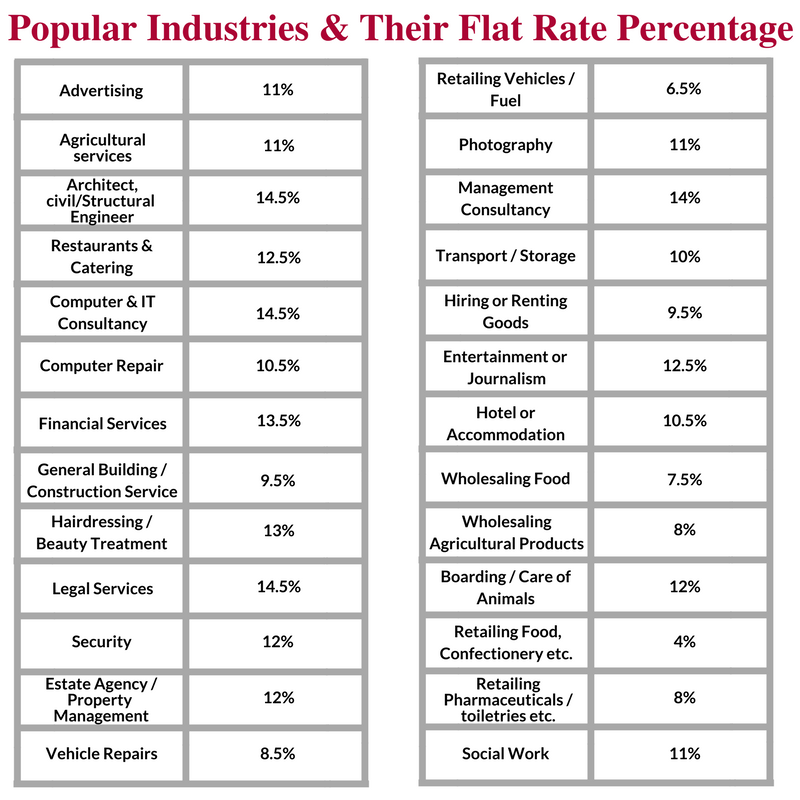

There is no standard flat rate for UK businesses, instead, the flat rate percentage varies from industry to industry. A business in the photography industry will incur a different percentage of VAT than a retail business.

Below we have provided a table displaying some of the most popular industries with their current VAT flat rate percentage.

Annual Accounting Scheme

Under the Annual accounting scheme, you will only need to file a VAT return once a year. Payments are calculated based on the previous years VAT liability – or as an estimate of future turnover if you’re a new business. There are multiple options available when it comes to actually paying HMRC. You can either opt for paying VAT on a quarterly basis – which is perhaps the simplest method; or alternatively, monthly payments can be made. These monthly payments are made from month 4 through to month 12, with the final balancing payment being made in month 14.

This scheme has clear cash flow advantages, particularly if your turnover is increasing from the previous accounting period, or if your business is subject to cyclical/seasonal peaks in trade. However, a cash flow advantage could also be perceived as a disadvantage if the business is suffering from a decline in turnover, there may be insufficient funds set aside for VAT payments.

Next Steps

In terms of understanding how, why, and when to register for VAT, and which scheme would be most suitable for your business, the best port of call to provide the right advice would be an accountant! At Price Davis we will ensure you understand everything you need to know regarding VAT for your business. As Xero Silver Partners, we can ensure the smooth recording and filing of your VAT returns with HMRC. For more information on the differing VAT schemes feel free to get in contact with craig@pricedavis.co.uk.